You sold a digital product. The buyer downloaded it. Two weeks later, your payment processor hits you with a chargeback for “item not received.”

Your stomach drops. You know they got the file—you saw the download in your logs. But now you’re out the product, the money, and facing a $15 chargeback fee. The buyer walks away with a free product while you scramble to prove something that should be obvious.

This happens to thousands of digital sellers every month. Unlike physical products with tracking numbers, digital goods leave sellers vulnerable to fraudulent disputes. Buyers can claim they never received a PDF, course, or software license even after accessing it multiple times. Without the right documentation, payment processors side with the customer almost every time.

The good side? You can win these disputes. You just need to document delivery the right way from the start.

Key Takeaways

- Collect verifiable proof of download through IP addresses, timestamps, and access logs for every transaction

- Implement email verification systems that confirm delivery before allowing downloads

- Set up automated systems that track when buyers open files, view content, or use license keys

- Create iron-clad Terms of Service that explicitly define “delivery” for digital products

- Respond to chargebacks within 7 days with organized evidence packages that processors actually read

Why “Item Not Received” Claims Work Against Digital Sellers

Traditional chargeback rules were written for physical products. Credit card networks expect tracking numbers, delivery confirmations, and signatures. Digital products don’t fit this model.

When someone buys a physical book from Amazon, there’s a tracking number, a delivery scan, and often photo proof. When someone buys an ebook, there’s… an email? Maybe a download button? Payment processors treat these differently.

Buyers know this gap exists. Some exploit it deliberately. They download your product, consume it completely, then file a chargeback claiming it never arrived. Others genuinely forgot they bought it or their kid made the purchase without permission.

Either way, you’re fighting an uphill battle. Visa’s rules favor cardholders in disputes. Mastercard’s do too. PayPal historically sides with buyers in 60-70% of digital product disputes. Stripe requires substantial evidence to overturn a chargeback.

The burden of proof sits entirely on you.

Building Your Evidence Trail Before Problems Start

You can’t win a chargeback fight six weeks after a sale if you didn’t collect evidence during the transaction. Start documenting from the moment someone clicks “buy.”

Transaction-Level Data You Must Capture

Your platform should automatically log these details for every purchase:

- Exact purchase timestamp with timezone

- IP address used for checkout

- Email address provided by buyer

- Device information (browser, operating system)

- Payment method details (last four digits, card type)

Most e-commerce platforms collect some of this automatically. Gumroad, Shopify, and WooCommerce all log basic transaction data. But you need to verify it’s actually being saved and you can access it later.

Test your system. Buy something from yourself using a different email address. Then try to find all the transaction details three days later. If you can’t pull up a complete record in under two minutes, your documentation system needs work.

Download and Access Tracking

This is where most sellers fail. Recording the sale isn’t enough—you need proof they accessed the product.

Set up systems that track:

- When files were downloaded (date, time, IP address)

- How many times they downloaded it

- Whether they opened or viewed the content

- If they activated license keys or login credentials

- Any interactions with your content delivery system

Services like SendOwl and FetchApp create unique download links for each buyer and track every access attempt. Some platforms like Teachable automatically log student course access for digital courses and membership sites.

If you’re hosting files yourself, implement logging through your server. Most hosting providers offer access logs that show file downloads by IP address and timestamp. You just need to know how to read them.

Email Delivery Confirmation

Don’t just send the product—prove they received the email containing it.

Use email services that provide delivery receipts. Mailgun, SendGrid, and Amazon SES all offer delivery tracking. They’ll show you when an email was delivered, opened, and if any links were clicked.

Save these receipts. A screenshot showing the buyer opened your delivery email at 3:47 PM and clicked the download link twice is powerful evidence.

Some sellers require email confirmation before allowing downloads. The buyer must click a verification link to prove they control the email address. This creates an additional proof point: they verified their email, then downloaded the file using that verified address.

| Evidence Type | What It Proves | How to Collect |

|---|---|---|

| Transaction logs | Purchase occurred | Payment platform exports |

| IP address records | Location consistency | Server logs, platform data |

| Download timestamps | File was accessed | CDN logs, delivery platform |

| Email open tracking | Communication received | SendGrid, Mailgun receipts |

| License activation | Product was used | Software activation logs |

Creating Terms of Service That Protect You

Your shop policies aren’t just legal fluff—they’re evidence in chargeback disputes. But most sellers write terms that actually hurt their case.

Define “Delivery” Explicitly

Don’t use vague language like “products will be delivered electronically.” That doesn’t help when a buyer claims they never got it.

Be specific: “Delivery is complete when the product download link is sent to the email address you provide at checkout. You are responsible for providing a valid email address and checking your spam folder.”

This shifts responsibility. The buyer can’t claim non-delivery if they gave you a bad email address or didn’t check their inbox.

No-Refund Policies for Digital Goods

You’re allowed to have a no-refund policy for digital products. Once someone downloads a PDF, you can’t get it back. Make this clear.

Include language like: “Due to the nature of digital products, all sales are final once the download link is accessed. We do not offer refunds for digital purchases.”

However, understand that no-refund policies don’t prevent chargebacks. Banks can still force a reversal. But having this policy documented strengthens your dispute response. It shows the buyer agreed to terms before purchasing.

Access Expiration Windows

Some sellers offer unlimited re-downloads. This creates problems. If someone can download your product anytime, how do you prove they didn’t try to download it before filing a chargeback?

Set time limits: “Download links remain active for 30 days after purchase. You may download the product up to 5 times during this period.”

When a buyer files a chargeback on day 45 claiming they never received the product, you can show they had 30 days to access it but didn’t even try. That looks suspicious.

Require Account Creation

Making buyers create an account before purchasing adds friction, but it also creates a documented relationship. They agreed to terms, verified an email address, and logged into a system to access their purchase.

This is harder to dispute than a one-click guest checkout with an email they claim isn’t theirs.

Responding to Chargebacks: What Actually Works

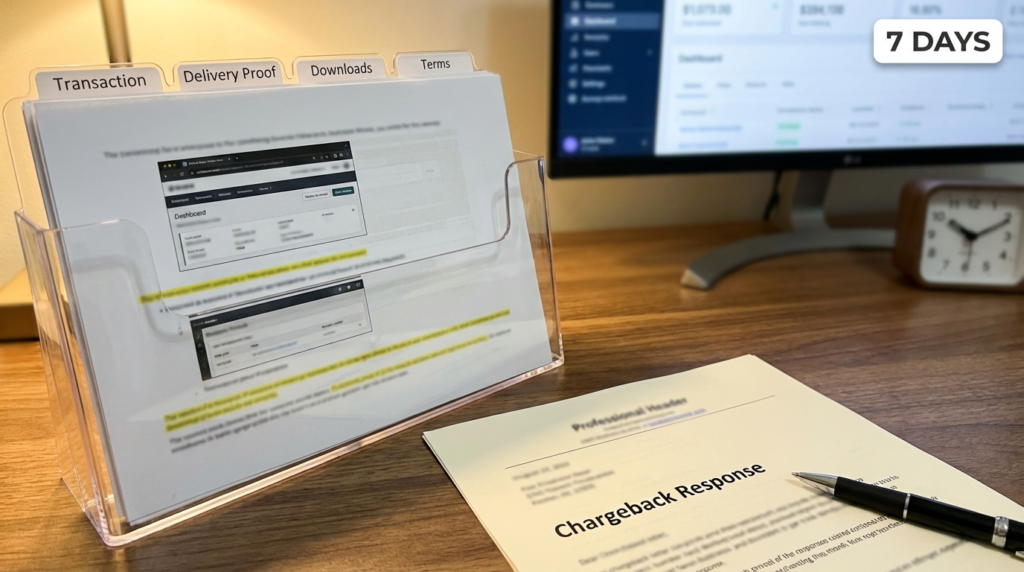

You get the notification. Someone filed a chargeback. You have 7-10 days to respond depending on the payment processor. What you submit determines whether you keep your money.

Organize Your Evidence Package

Payment processors review hundreds of chargeback disputes daily. If they can’t understand your evidence in 30 seconds, you lose.

Create a single PDF document that includes:

- A brief cover letter explaining the situation in plain English

- Transaction receipt showing purchase date, amount, and buyer email

- Screenshots of your product delivery email with timestamp

- Download logs showing when they accessed the file (with IP address)

- Email delivery confirmation proving they received communications

- Your Terms of Service with the relevant sections highlighted

- Any communication with the buyer (if applicable)

Label everything clearly. “Exhibit A: Purchase Receipt,” “Exhibit B: Download Log,” etc. Make it easy for the reviewer to follow your argument.

Write a Compelling Rebuttal Letter

Don’t write a novel. Don’t be emotional. State facts.

A strong rebuttal letter follows this structure:

- Opening statement: “This chargeback is fraudulent. The buyer successfully downloaded the product on [date] at [time].”

- Evidence summary: “Attached evidence shows the buyer received the delivery email, clicked the download link twice, and accessed the file from IP address [X].”

- Terms agreement: “The buyer agreed to our Terms of Service at checkout, which states all digital sales are final and delivery is complete upon email transmission.”

- Conclusion: “Based on the evidence provided, we request this chargeback be reversed and the funds returned to our account.”

Keep it under one page. Reference your exhibits. Be professional.

Common Mistakes That Lose Disputes

Sellers lose winnable chargebacks by making these errors:

Submitting irrelevant evidence. Sending your entire website’s Terms of Service when only two paragraphs matter. Processors won’t read 15 pages.

Missing deadlines. If you respond on day 8 and the deadline was day 7, you automatically lose. Set calendar reminders when chargebacks arrive.

No proof of delivery. Saying “I sent them the file” without logs, screenshots, or timestamps proves nothing.

Arguing instead of proving. “The buyer is lying” isn’t evidence. Show them the download logs that prove it.

Inconsistent data. If your transaction record shows one IP address but the download came from another country entirely, that raises questions. Be prepared to explain discrepancies.

Technical Solutions for Better Protection

Manual evidence collection works for small operations. But if you’re selling dozens or hundreds of digital products monthly, you need automation.

Platforms with Built-in Chargeback Protection

Some e-commerce platforms offer chargeback management tools designed for digital products:

- Gumroad automatically tracks downloads and creates evidence packages for disputes

- Payhip logs all file access and provides dispute documentation

- SendOwl creates unique download links with full tracking per customer

- WooCommerce with plugins like Digital Downloads Manager adds detailed logging

These platforms won’t prevent chargebacks, but they make evidence collection effortless. Everything gets logged automatically.

Two-Factor Delivery Verification

Require buyers to verify their email AND confirm their download. This creates two proof points instead of one.

After purchase, send an email requiring verification. Once verified, send the download link. If they download the file, you have proof they:

- Verified email ownership

- Received the delivery email

- Clicked the download link

- Accessed the file (with timestamp and IP)

That’s much harder to dispute than a single email send.

Watermarking and Fingerprinting

Some sellers embed buyer information into digital products. A PDF might include the purchaser’s email address in the footer or metadata. Software might phone home with a license key.

This won’t stop chargebacks, but it discourages them. If a buyer knows their email address is embedded in your PDF, they’re less likely to share it publicly or claim they never received it.

When to Fight vs. When to Accept the Loss

Not every chargeback is worth fighting. Your time has value too.

Fight the chargeback if you have solid evidence and the amount exceeds $50. The time investment to compile evidence for a $10 ebook sale might not be worth it, even if you’d win.

Accept the loss if you legitimately can’t prove delivery. If your logging system failed, your email service didn’t track opens, or you don’t have download records, fighting is pointless. You’ll lose and waste time.

Also consider the buyer’s history. If someone made five purchases from you previously without issues, then suddenly filed one dispute, something else might be happening. Their card could’ve been stolen. They might’ve genuinely not received that specific email due to a technical glitch.

Use judgment. Don’t automatically assume fraud.

Building Long-Term Prevention Systems

The best chargeback defense is preventing them from happening.

Improve Your Delivery Process

Most legitimate “item not received” claims happen because of poor communication, not fraud.

Send confirmation emails immediately after purchase. Make them clear and obvious. Subject line: “Your [Product Name] Is Ready to Download” works better than “Order Confirmation #43829.”

If downloads are delayed (you manually send files, for example), tell buyers upfront. “You’ll receive your download link within 2 hours” sets expectations.

Test your delivery system monthly. Buy from yourself using different email providers. Gmail, Outlook, Yahoo, and ProtonMail all have different spam filters. Make sure your delivery emails aren’t landing in spam folders.

Add Friction to Guest Checkouts

Guest checkouts are convenient but risky. Someone can enter any email address, and you have no way to verify they actually own it until after the purchase.

Requiring account creation adds one extra step, but it dramatically reduces fraud and disputes. The buyer must verify email ownership before buying, which creates stronger proof of legitimate transaction.

Implement Purchase Limits for New Customers

If someone creates an account and immediately buys $500 worth of digital products, that’s suspicious. Legitimate customers typically start with one item.

Set purchase limits for brand-new accounts: “First-time customers can purchase up to $100 in their first transaction. This limit increases after successful delivery.”

This won’t stop all fraud, but it limits your exposure per incident.

Frequently Asked Questions

Can I win a chargeback if the buyer used a stolen credit card?

Usually no. If the real cardholder reports their card as stolen, that’s fraud, not “item not received.” Different rules apply. Your evidence showing delivery won’t matter because the person who filed the chargeback never made the purchase. This is why fraud detection tools are important for high-value items.

What if I can prove they downloaded the file but they claim it was corrupted?

“Item not received” and “product defective” are different dispute codes. If they claim corruption, you need to prove the file worked properly. Offer to resend it or provide technical support. Keep records of all communication. Most processors will side with buyers on quality disputes for digital goods unless you can prove the file was tested and functional.

Should I refund immediately if someone threatens a chargeback?

Depends on your situation. If they legitimately didn’t receive the product due to your error, refund them. It’s cheaper than fighting a chargeback. But if they clearly downloaded the file and are trying to scam you, don’t reward bad behavior. Stand your ground with evidence.

How long do I need to keep transaction records and download logs?

Keep everything for at least 180 days. Most credit card chargebacks must be filed within 120 days of purchase, but some card networks allow longer windows for specific situations. After 180 days, risk drops significantly. Store records in organized folders by month for easy retrieval.

Protect Your Revenue Before the Next Dispute Hits

Chargebacks on digital products are frustrating, but they’re not unavoidable. Start documenting every transaction today. Implement tracking systems that capture download activity automatically. Write clear Terms of Service that define delivery precisely.

When the next dispute arrives—and it will—you’ll have everything needed to fight back successfully. The buyer might claim they never received your product, but your evidence will tell a different story.

Set up your logging systems this week. Test your delivery process. Verify your email tracking works. Don’t wait until you’re facing a chargeback to realize your documentation has gaps.

What’s your biggest challenge with digital product chargebacks? Drop a comment below—other sellers facing similar issues might have solutions that worked for them.