You’ve got a brilliant idea. You launch a crowdfunding campaign, hit your funding goal, and celebrate. Then reality hits—manufacturing costs spike, suppliers ghost you, or the product just won’t work. Now you’re sitting on $50,000 of other people’s money with nothing to show for it.

Here’s what most creators don’t realize: when you accept crowdfunding money, you’re entering a legally binding agreement. It’s not a donation. It’s not “free money.” You’ve made promises that come with real consequences if you can’t deliver. And the platform you choose—Kickstarter or Indiegogo—dramatically changes what happens when things go wrong.

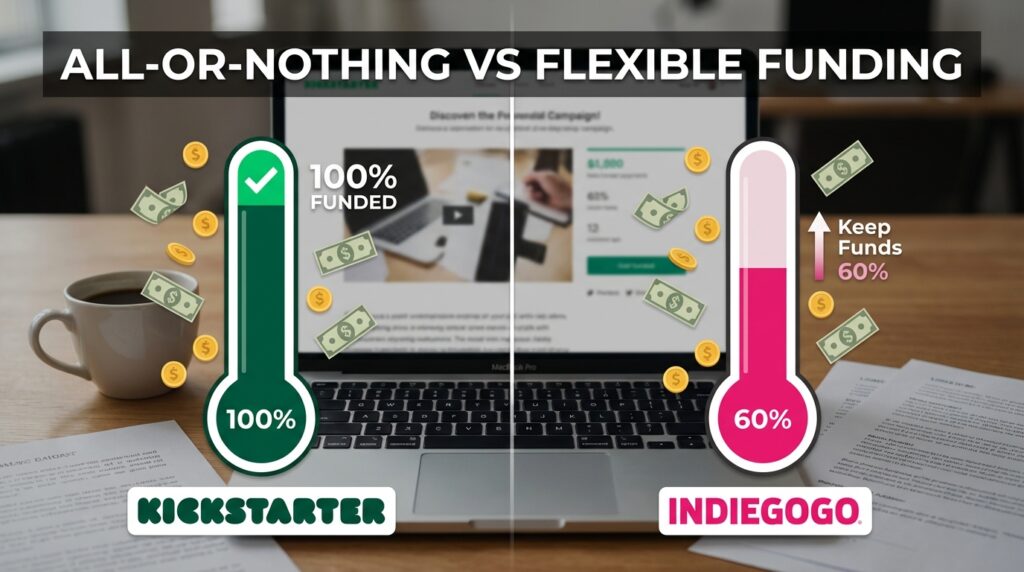

This gets messy because each platform operates under different models with different legal implications. Kickstarter’s “all or nothing” approach means you only get funded if you hit your goal, but then you’re on the hook for everything you promised. Indiegogo offers flexible funding where you keep whatever you raise, which sounds great until you realize you might not have enough money to fulfill orders but you’re still legally obligated to try.

Key Takeaways:

• Accept that crowdfunding creates a binding contract between you and backers, not a tip jar • Know that Kickstarter’s Terms of Use explicitly require you to complete your project or refund backers • Understand Indiegogo’s flexible funding lets you keep money even if you miss your goal, but delivery obligations remain • Recognize that creators face FTC action, class-action lawsuits, and state attorney general investigations for non-delivery • Document everything when problems arise—transparent communication can reduce legal exposure

The Legal Reality Behind Crowdfunding Platforms

When you click “launch campaign,” you’re not just posting on social media hoping people like your idea. You’re creating what contract law calls a bilateral agreement. Backers give you money. You promise specific rewards by specific dates. Courts have repeatedly confirmed this isn’t a gray area.

The Federal Trade Commission went after a Kickstarter creator in 2015 who raised $122,000 for a card game and never delivered. They didn’t care that he ran into problems. They cared that he spent backer money on personal expenses instead of trying to fulfill rewards. He settled and had to pay back backers.

State attorneys general have gotten involved too. Washington State sued two Kickstarter campaigns that failed to deliver, establishing that crowdfunding campaigns must follow the same consumer protection laws as any business selling products.

Your platform choice doesn’t exempt you from these laws. It just changes how the contract works.

How Kickstarter’s All-or-Nothing Model Actually Works

Kickstarter takes a hard line. You set a funding goal. If you don’t reach it by your deadline, nobody gets charged and you get nothing. This protects both creators and backers from half-funded projects that can’t possibly succeed.

But once you cross that funding threshold, the money becomes yours—and so do the obligations.

Kickstarter’s Terms of Use state that creators “are required to fulfill all rewards of their successful fundraising campaigns or refund any backer whose reward they do not or cannot fulfill.” That’s not a suggestion. It’s a requirement you agree to when you launch.

This creates three possible outcomes:

You deliver everything you promised on time. You’re done. Success.

You hit problems but communicate clearly, adjust timelines, and eventually deliver. Backers might grumble, but you’ve fulfilled your contract.

You take the money and can’t deliver anything. Now you’re in breach of contract territory, and backers can pursue legal action.

The “all or nothing” part only applies to whether you get funded. Once funded, there’s no “all or nothing” about your delivery obligations. You owe backers what you promised, period.

Indiegogo’s Flexible Funding Changes Everything

Indiegogo offers two options: fixed funding (like Kickstarter’s model) and flexible funding, where you keep whatever you raise even if you miss your goal.

Flexible funding sounds great for creators. Why risk getting nothing? But this creates a dangerous scenario that many creators don’t think through.

Let’s say you need $30,000 to manufacture your product. You set a flexible funding goal of $50,000 hoping for some buffer. The campaign ends at $18,000. Indiegogo takes their cut (about $1,260), and you’re left with roughly $16,740.

You still owe rewards to everyone who backed you. But you don’t have enough money to manufacture the product at scale. You can’t deliver. But legally, you still have to try or refund everyone.

Indiegogo’s Terms of Use are slightly different from Kickstarter’s. They position the platform as a neutral space where campaigners and contributors make direct agreements. Indiegogo states they’re not responsible for campaigns that don’t deliver. But that doesn’t mean creators aren’t responsible—it just means Indiegogo won’t enforce it for backers.

This shifts more risk onto backers while still leaving creators legally exposed to the same FTC rules and state consumer protection laws.

What “Legally Obligated” Actually Means

The phrase “legally obligated” sounds intimidating, but what does it mean in practice? It means backers have multiple ways to come after you if you don’t deliver.

Individual small claims court: Backers can sue you in small claims court for their pledge amount plus fees. If you had 500 backers at $50 each, that’s 500 potential lawsuits. Most won’t bother, but some will.

Class-action lawsuits: When enough backers get burned, lawyers start organizing class actions. These can be expensive to defend even if you eventually win. The Coolest Cooler campaign raised $13 million on Kickstarter and faced class-action threats when delivery dragged on for years.

FTC enforcement: The Federal Trade Commission can go after creators for deceptive practices or misusing funds. They don’t need backers to file complaints—they can act on their own.

State consumer protection agencies: Attorneys general in states like Washington have been aggressive about pursuing crowdfunding campaigns that don’t deliver.

You can’t hide behind “it’s just crowdfunding” or “I tried my best.” The law treats this like any other commercial transaction.

| Legal Risk | Kickstarter All-or-Nothing | Indiegogo Flexible Funding |

|---|---|---|

| Contract obligation | Triggers only if fully funded | Triggers at any funding level |

| Backer expectations | High (project should be viable) | Mixed (backers know goal wasn’t met) |

| FTC exposure | Same across platforms | Same across platforms |

| Refund pressure | Intense if no delivery | Intense if no delivery |

| Platform enforcement | Will suspend repeat offenders | Will suspend repeat offenders |

When Campaigns Go Sideways: Real Consequences

The Asylum Playing Cards campaign raised $25,000 on Kickstarter in 2012. The creator, Ed Nash, never delivered cards. The FTC sued him in federal court. Nash settled by agreeing to refund backers and avoid misrepresenting future projects.

What happened? Nash apparently spent the money on unrelated business expenses rather than trying to fulfill rewards. That crossed the line from “honest failure” to “consumer fraud.”

The Altius Duo-Power Trainer raised $25,000 on Kickstarter and also never delivered. The Washington State Attorney General sued under the state’s Consumer Protection Act. The creator settled and had to pay restitution.

These aren’t huge campaigns. They’re modest projects where creators thought they could take the money and walk away if things didn’t work out. They were wrong.

Even campaigns that eventually deliver can face consequences. The Oculus Rift started on Kickstarter, delivered headsets to backers, then got acquired by Facebook for $2 billion. Backers felt cheated because they backed what they thought was an indie project, not a Facebook product. No laws were broken, but the backlash taught creators that backer expectations matter beyond just delivering physical rewards.

The Difference Between Honest Failure and Fraud

Courts and regulators distinguish between two scenarios.

Honest failure: You genuinely tried to complete the project. You spent backer funds on the project, not personal expenses. You communicated problems as they arose. You eventually offered refunds or partial delivery. This isn’t illegal, though backers can still sue for breach of contract.

Fraud: You knowingly misrepresented your ability to deliver. You spent funds on things unrelated to the project. You went silent and stopped communicating. You had no intention of delivering from the start. This gets you in real legal trouble.

The Indiegogo campaign for a gaming device called SMACH Z raised over $700,000. Delivery was supposed to happen in 2016. By 2019, nothing had shipped and communication had mostly stopped. Backers organized, shared evidence the company was using funds for other projects, and filed complaints. Whether this crosses into fraud territory depends on what prosecutors can prove about intent.

Intent matters. If you can show you genuinely tried to deliver but ran into insurmountable problems, you’re in a much better position than if emails reveal you knew from the start you couldn’t deliver what you promised.

Protecting Yourself as a Creator

You don’t launch a campaign hoping to fail, but smart creators plan for problems.

Build a realistic budget with a 30-40% buffer for unexpected costs. Manufacturing always costs more than your first quote. Shipping internationally gets complicated. Customs holds up shipments. Something will go wrong.

Communicate obsessively with backers. Post monthly updates even when nothing major has changed. When problems hit, tell backers immediately. Transparency doesn’t eliminate legal risk, but it builds goodwill that can prevent lawsuits.

Document everything. Keep receipts showing you spent backer funds on the project. Save emails with manufacturers, designers, and vendors. If you end up in court or dealing with the FTC, this documentation proves you made good-faith efforts.

Understand your platform’s insurance options. Some creators take out insurance policies that cover refunds if they can’t deliver. It’s expensive, but less expensive than a lawsuit.

Get legal help before you launch, not after things collapse. An attorney can review your campaign page to make sure your promises are realistic and your legal language protects you as much as possible.

Indiegogo InDemand and Ongoing Obligations

Indiegogo offers something Kickstarter doesn’t: InDemand. After your campaign ends, you can keep accepting orders for your product. This extends your obligations indefinitely.

If you run an InDemand campaign for two years and keep accepting money from new backers, you can’t suddenly decide you’re tired of fulfilling orders and shut down. Every new backer creates a new contract with new delivery obligations.

Some creators use InDemand to slowly fulfill orders from their original campaign while raising money from new backers. This works if you’re actually delivering. It becomes a legal nightmare if you’re just collecting money with no real plan to ship products.

What Happens to Your Money After Fees

Understanding cash flow helps explain why creators get in trouble.

| Item | Kickstarter | Indiegogo Flexible |

|---|---|---|

| Platform fee | 5% of funds raised | 5% of funds raised |

| Payment processing | 3-5% depending on payment method | 3-5% depending on payment method |

| Your net proceeds | ~90-92% of total raised | ~90-92% of total raised |

| Funds released | After campaign ends (if goal met) | After campaign ends (any amount) |

If you raise $50,000, you’re actually getting about $46,000 after fees. If you budgeted for $50,000 worth of rewards, you’re already short before you even start.

Add manufacturing, shipping, packaging, and handling damages, and that $46,000 might only cover 70% of your actual costs. This is where creators panic and start making bad decisions like going silent or spending money elsewhere hoping to earn enough to come back and fulfill later.

Platform Enforcement and Backer Protections

Both platforms will ban creators who repeatedly fail to deliver, but this doesn’t help backers get their money back.

Kickstarter’s Trust & Safety team investigates campaigns that backers report. They can suspend accounts and ban creators from launching future campaigns. But they don’t force refunds or mediate disputes. Their Terms of Use explicitly state they’re not responsible for project completion.

Indiegogo operates similarly. They’ll investigate fraud and shut down campaigns that violate their terms, but they don’t guarantee delivery or refunds.

Payment processors offer some protection. If you used a credit card to back a campaign, you might be able to dispute the charge within 120 days. After that window closes, your credit card company won’t help.

PayPal has a 180-day dispute window. If you backed a campaign that said delivery would happen within six months and nothing showed up, you might be able to file a PayPal dispute.

These time limits create urgency for backers to act quickly when campaigns go bad, but most crowdfunding projects take longer than six months to deliver, closing these protection windows before problems become obvious.

Writing Your Campaign to Minimize Legal Risk

The words you use on your campaign page matter legally. Courts look at what you promised when deciding if you breached your contract.

Don’t promise specific delivery dates unless you’re absolutely certain. Use language like “estimated delivery” rather than “will ship by.” Estimates give you some legal breathing room when delays happen.

Be clear about what backers are getting. If you’re offering a prototype reward tier, label it clearly as “early prototype – may have issues” rather than implying it’s a finished product.

Explain what could go wrong. The best campaign pages include a “Risks and Challenges” section that outlines potential problems. This sets realistic expectations and shows backers you’ve thought through difficulties.

Don’t oversell your experience or capabilities. If this is your first time manufacturing a product, say so. If you’ve never run a business before, be honest. Misrepresenting your qualifications can turn honest failure into fraud.

The Refund Dilemma

What do you do if you know you can’t deliver? The legally correct answer is to offer refunds to all backers. The practical problem is that you probably don’t have the money anymore.

You spent it trying to manufacture the product. Or the manufacturer took your deposit and disappeared. Now you’ve got $0 in the bank and 300 backers demanding their $75 back.

Legally, you still owe those refunds. Practically, you might need to declare bankruptcy. Personal bankruptcy won’t necessarily discharge your crowdfunding debts if courts determine you acted fraudulently, but it might be your only option if you genuinely can’t pay.

Some creators offer partial refunds or alternative rewards. “I can’t deliver the product, but I can refund 30% of your pledge and send you this related item instead.” Some backers accept this. Others sue anyway.

There’s no good solution here. Your best bet is to avoid reaching this point through careful planning and honest communication before you run out of money.

Frequently Asked Questions

Can I cancel my crowdfunding campaign before it ends to avoid obligations?

Yes, you can cancel a campaign before the deadline on both platforms. On Kickstarter, if you cancel before the campaign ends, backers don’t get charged and you have no obligations. On Indiegogo fixed funding, the same applies. But with Indiegogo flexible funding, if you’ve collected any money before canceling, you still need to refund it to backers.

What happens if I deliver rewards late but eventually deliver everything?

Late delivery alone isn’t illegal. Backers might be frustrated, but if you deliver what you promised (even years late), you’ve fulfilled your contract. Your reputation takes a hit, but you’re not facing legal action. Communication during delays matters—staying silent makes backers think you’ve abandoned the project and increases the chance they’ll pursue legal options.

Does Kickstarter or Indiegogo help enforce delivery or get refunds for backers?

No. Both platforms explicitly state they’re not responsible for project completion. They provide the platform for creators and backers to connect, but they don’t mediate disputes, force refunds, or guarantee delivery. Backers need to pursue creators directly through small claims court, class-action lawsuits, or government agencies.

Am I personally liable for crowdfunding debts or is it limited to my business?

This depends on how you structured your business. If you ran the campaign as an individual or sole proprietorship, you’re personally liable. If you set up an LLC or corporation before launching, your personal assets might be protected (though if courts find fraud, they can “pierce the corporate veil”). Most small creators launch as individuals and don’t realize they’re putting personal assets at risk.

Moving Forward With Clear Eyes

Crowdfunding isn’t free money. It’s a contract with legal teeth. The platform you choose affects how you get funded, but both Kickstarter and Indiegogo create binding obligations once you accept backer money.

All-or-nothing funding protects you from getting stuck with insufficient funds, but it doesn’t reduce your delivery obligations once funded. Flexible funding gives you money regardless of your goal, but leaves you obligated to deliver even when you don’t have enough capital to do it right.

Document your spending. Communicate constantly. Budget conservatively. Get legal advice before you launch. And if things go wrong, don’t disappear—work with backers to find solutions before lawyers get involved.

The successful campaigns aren’t always the ones with the best products. They’re the ones where creators understood the legal reality from day one and planned accordingly.

What’s been your experience with crowdfunding—either as a creator or a backer? Drop a comment below and share what you’ve learned.